Savings And Loan Association in New York

Business Type Information

Basic details about the type of business.

- Jurisdiction

- New York

- Country

United States (US , USA)

- Subregion

- North America

- Region

- Americas

- Language

- English

- Language Code

- EN

- Created date

- Sep 23, 2021

- Last modified date

- Mar 19, 2024

- Tags

Legal Entity Management Made Simple

Start using

Lextree today.

Control even complex legal entities.

Learn more about entity management software

There are five important principles for managing a Savings and Loan Association in the United States. Those principles are: ownership or business structure, compliance, governance and management, documentation, and notifications.

New York Savings and Loan Association Ownership and Business Structure

Businesses are structured differently around the world based on the legal and economic system in the jurisdiction. Each type of legal entity is owned, controlled, or formed by people. A Savings and Loan Association is no exception.

As a legal fiction, it is important to know who owns or controls the business. Ownership tracking means identify the people (or other companies) which have a legal or economic interest in the business. Legal and economic rights include the right to vote ("Voting Rights") on important business matters and the right to a share of profits and losses ("Economic Rights"). Not all business types have profits to distribute.

Ownership tracking is important for many reasons. It is important for tax purposes, for compliance with laws and regulations, and for the protection of the business and its owners.

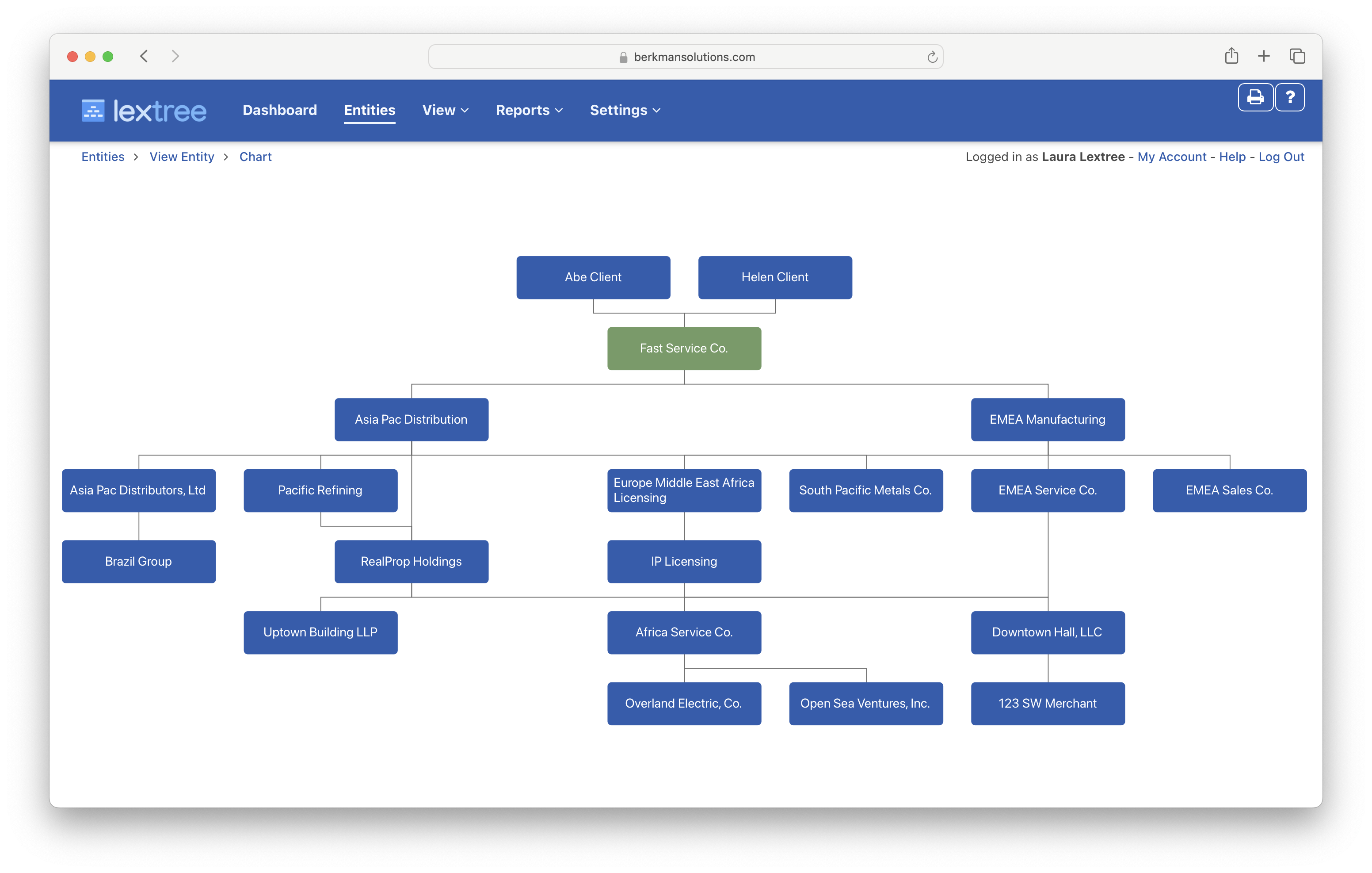

One of the best reasons to track ownership is to create organization charts automatically.

In the United States, ownership tracking is especially important for compliance with the Corporate Transparency Act. The Corporate Transparency Act requires that reporting companies identify and disclose Beneficial Owners.

New York Savings and Loan Association Compliance and Requirements

As a legal entity, a business must comply with national, state or provincial, and local laws. Compliance often means business filing requirements.

Compliance also means following the rules and regulations of the industry in which the business operates. For example, a Savings and Loan Association in the United States must comply with the laws and regulations of the United States government. It must also comply with the laws and regulations of the industry in which it operates.

Compliance is important to reduce the risk of fines and penalties.

Compliance tracking for businesses is an ongoing process for the life of the company. Whether it is tracking the annual report or business licenses, entity management software to track compliance is vital.

New York Savings and Loan Association Governance and Management

Every business has a governance structure. Governance is the system of rules, practices, and processes by which a company is directed and controlled. Governance is important for the success of the business. It is also important for the protection of the business and its owners.

Governance systems, laws, and practices vary across jurisdictions. Think about governance on two levels: the group (for example, a Board of Directors) which sets broad strategy and overseas the management; and the senior managers who direct daily operations of the business.

Governance tracking means knowing who has what title and role in the company. It is also useful, and sometimes required, to track the person's term of service (appointment date and termination date).

In the United States, governance tracking is especially important for compliance with the Corporate Transparency Act.

New York Savings and Loan Association Documents and Records

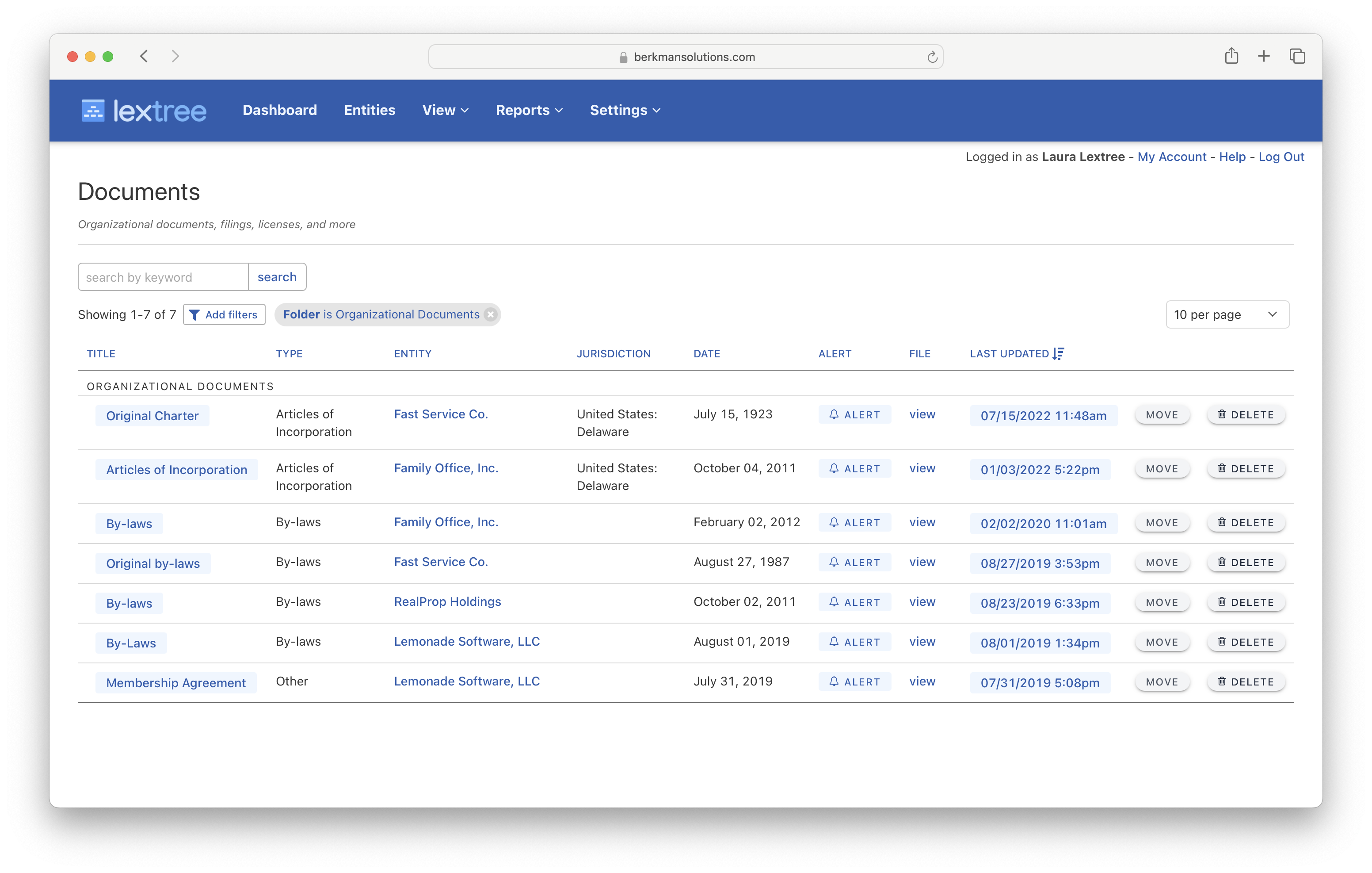

Every business has documents and records that need tracking. Sometimes it is a simple matter of using a document management system. Businesses have special reporting and tracking needs related to documents.

For example, a Savings and Loan Association in the United States may need to track annual reports, minutes of meetings, and organizational documents.

Alerts and Notifications

All of that tracking for ownership, governance, compliance, and documents helps create legal entity reports. More important, however, is that entity management software can send automatic alerts and notifications about critical deadlines.

Conclusion

Managing a Savings and Loan Association in the United States is a complex task. It requires tracking ownership, compliance, governance, documents, and notifications. Entity management software can help.

References