What Corporate Structure Means for Your Business

Updated:

Why create a corporate structure?

An effective corporate structure delivers three benefits:

- Segmented financial reporting,

- Risk management, and

- Better regulatory compliance.

Corporate structures can be simple or complex, but they all factor in management and ownership decisions.

Difference between management and ownership structures

Management and ownership combine to form a corporate structure. Management and ownership are related, but distinct for our purposes.

Management structure

The corporate structure of a business starts with the roles created in the organizational documents for the entity.

These are typically called “officers.” It is common, for example, that US corporations have the following officers:

- President and Chief Executive Officer

- Treasurer

- Secretary

There might be more officers. Each officer’s roles and responsibilities come from the relevant statute and the organizational documents.

We will discuss the legally significant roles more thoroughly in the Legal Form section. Wait! What about the Board of Directors? The Board of Directors represents the intersection of the ownership structure and the management structure.

Some jurisdictions require a dual board structure: one board is supervisory; one is managerial.

Corporate structure includes another layer beyond the officers created with the entity.

The management portion of corporate structure includes the organizational chart of job titles and reporting relationships. In this context, management is focused on business operations.

These relationships are not “legally significant” in that the organizational documents do not mention them. There is no “Director of Product Marketing” in the Bylaws.

The internal management structure is meaningful for the business. The internal, non-legal, management structure correctly receives the most attention.

Management structure includes matrix, divisional, and functional designs. Whatever the HR org chart shows from the CEO on down is the internal management structure.

Ownership structure

With a few exceptions, businesses have owners. The nature and number of owners vary widely.

Owners can be individuals or other businesses. To complicate matters, an owner’s rights to the business can be split between management and economic rights. Management rights refer to the ability to influence the appointment of officers. Economic rights include the right to receive proceeds of the business.

Many businesses also own other business. There are basically three levels of ownership in a corporate structure: parents, affiliates, and subsidiaries.

Parents own subsidiaries. The amount of ownership interest can range from a fraction of a percent to 100%. In the org chart here, Sonoma, Inc. is a parent of Great NewCo, Inc.

An affiliate is a sibling legal entity. For example, Maker Group is an affiliate of New Lux Example in this image. Conversely, New Lux Example is an affiliate of Maker Group.

This approach to ownership structure includes situations like joint ventures, outside investors, closely held companies, and publicly traded firms.

Factors that determine a corporate structure

Business leaders and lawyers make decisions about the corporate structure to achieve specific objectives or deal with identified risks.

Consider these four factors for corporate structures:

- Legal form of the entity,

- Governing jurisdictions,

- Type of ownership, and

- Strategy or business objectives.

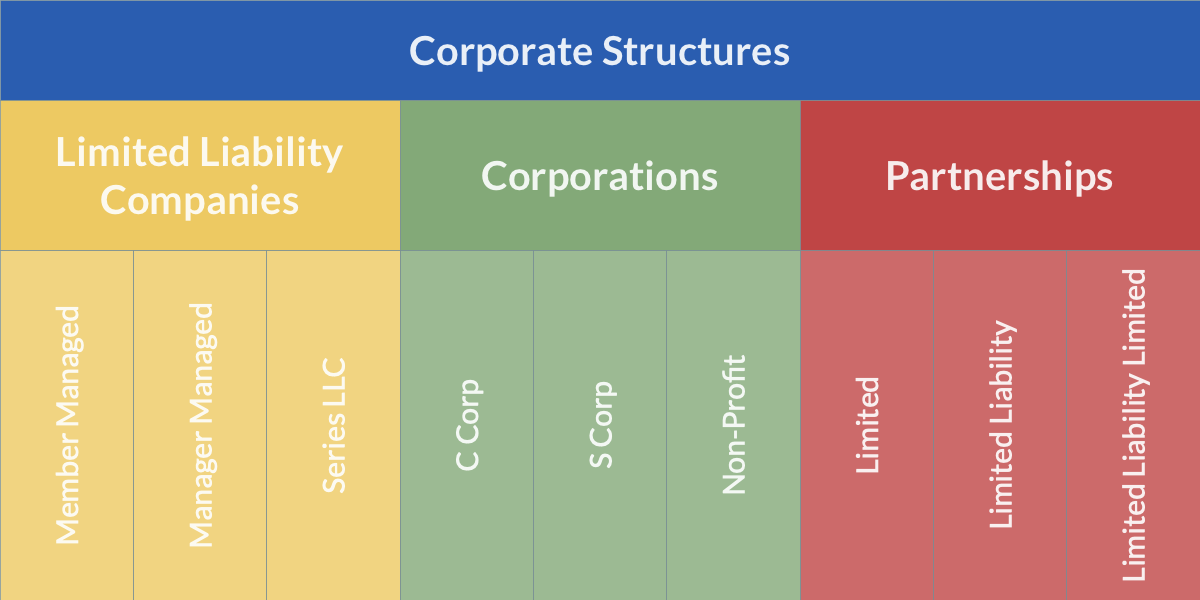

Legal form

The legal form of the entity in question can influence the terminology for both internal and external structures.

The terms for owners and managers in various corporate structures are listed in this table.

| Type of Structure | Ownership | Management |

|---|---|---|

| C Corporation | Shareholders | Officers |

| S Corporation | Shareholders | Officers |

| Limited Liability Company | Members | Managers |

| General Partnership | Partners | Partners |

| Limited Partnership | Limited Partners | General Partner |

There are a couple of caveats. First, the organizational documents for any particular entity can modify these general rules. For example, technology startups often organize as LLCs but use a corporate management style.

Governing jurisdictions

The place of incorporation is the source of law for forming your type of entity. A corporation in California uses California law, an LLC in New York uses New York law, and so on. While there are many commonalities, each jurisdiction may impose limits on both internal and external corporate structure.

The Internal Revenue Service also creates restrictions on corporate structure. For example, under federal tax law, S Corporations cannot have more than 100 shareholders to qualify for pass-through tax status.

Type of ownership

The form of ownership traces a spectrum from the simple to the complex.

Partnerships usually convey “partnership interests” to each partner.

Limited Partnerships, including limited liability partnerships, might refer to “limited partnership interests” or “limited partnership units”.

Limited liability companies call ownership units “membership interests.” Some jurisdictions allow an almost corporate approach to units of ownership for LLCs.

Corporations can simply have “shareholders” or “stockholders”. Whether there are 2 or 2,000, the structure is simple.

Corporations can also have complex ownership structures where equity includes, classes of stock, options, warrants, and convertible debt holders.

Strategy and business objectives

Most importantly, the objectives of the business are critical to designing a corporate structure. A US corporation which wants to enter the Argentinian market will need to form an Argentinian legal entity. It will have to make choices about management and ownership under local law. Those choices will also influence the results of the business back in the US.

An LLC creates a subsidiary that it plans to take public. Initial Public Offerings (IPOs) are typically accomplished by selling stock in corporations. The parent LLC forms the new entity as a C corporation.

Conclusion

Corporate structuring can enhance the value of any business. It is important to consider the legal form, the governing jurisdictions, type of ownership, and business objectives.