Trends in New Business Entities - 30 years of data

Updated:

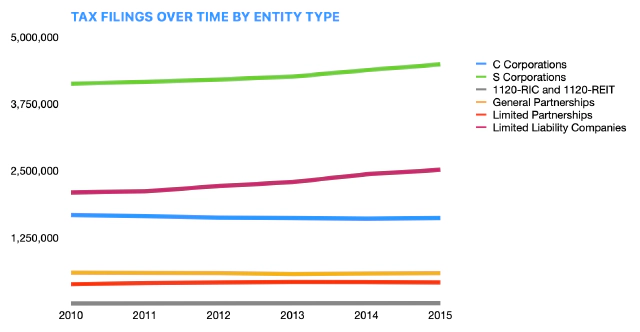

We wanted to provide an update based on the most recent years 2010 - 2015 available from the Internal Revenue Service.

This table shows the cumulative change in entity tax filings from 2010 through 2015 for C Corporations, S Corporations, General Partnerships, Limited Partnerships, Limited Liability Companies, and more.

The trend lines show the changes over time.

Introduction

Data on business incorporations by legal entity type is maybe not so surprisingly difficult to locate. Business entities are creatures of state law, shaped in part by federal tax and securities law.

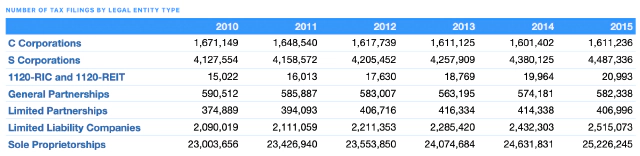

We have analyzed 30 years of federal tax return data about the types of legal entities. The Internal Revenue Service publishes data based on tax returns filed by various types of business entities.1 We analyzed the data on seven categories of business entities: C Corporations, S Corporations, general partnerships, limited partnerships, limited liability partnerships, sole proprietorships, and 1120-RIC and 1120-REIT entities:

2012 is the most recent year as of this article. This article focuses on four legal entity types:

- Corporations,

- S Corporations,

- Partnerships, grouping general and limited partnerships together, and

- Limited liability companies.2

These four comprise the majority of entities which business lawyers incorporate and maintain. Sole proprietorship (non-farm) tax returns dwarf all other business tax returns: 23.6 million compared to 9.2 million in 2012. Sole proprietorship data is not helpful to business lawyers advising corporate clients or management teams.

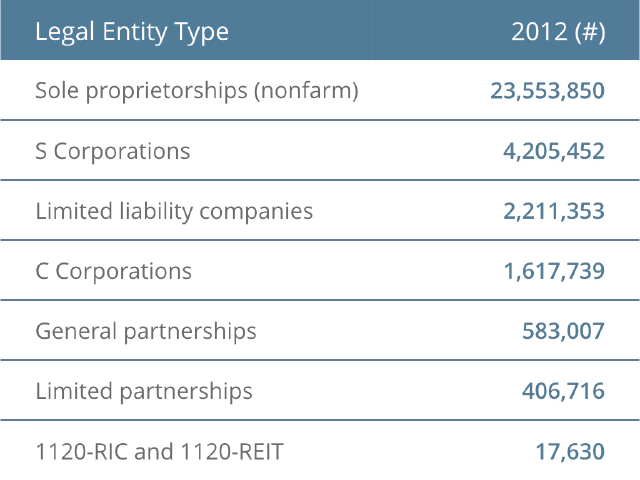

Corporations v. Partnerships

The Internal Revenue Service data on filed tax returns is grouped into three broad categories: corporations, partnerships, and sole proprietorships. Setting aside sole proprietorships, the IRS data demonstrates a clear long term preference for corporations. The flattening of the growth in corporations since 2005 raises the question about what is going on underneath these broad buckets.

The first problem with the IRS categorization is that it does not capture the economic (tax planning) strategies that drive entity selection. The IRS division is mistakingly based on legal form rather than tax treatment.

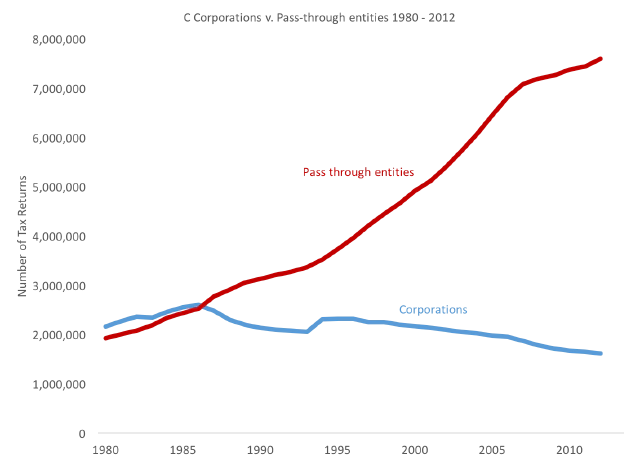

It is more illuminating to organize the entities by tax classification: corporate and pass-through entities.

Corporate v. Pass-through tax classification

As reported, the IRS data lumps S Corporations with C Corporations. This is rational from a state corporate law perspective since they are both usually organized according to the corporate statute of the state of incorporation. Both share characteristics of corporations. The C and S refer to federal tax status (specifically the relevant chapter of the Internal Revenue Code), not a state law designation.

Under federal tax law, C and S Corporations differ dramatically. C Corporations operate under a double taxation regime. The corporate entity is taxed on its income; the shareholder is taxed on profits paid as dividends.

An S Corporation, however, is generally taxed as a pass-through entity. The shareholders are taxed on the income of the corporation. In an S Corporation, there is generally no double taxation. While an S Corporation is a corporation for state law purposes, it behaves more like a partnership for federal tax purposes.

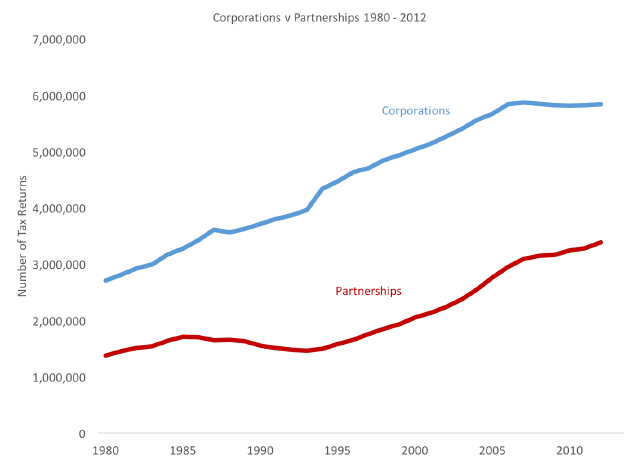

When we move the S Corporation tax returns in the IRS data to a new group made of pass-through or disregarded legal entities, the long term trend is quite different. This new group of pass-through entities consists of S Corporations, General Partnerships, Limited Partnerships, all other partnerships, and Limited Liability Companies.

For purposes of organizing startups, forming active joint ventures, and managing corporate entities, the distinction between corporations and pass-through entities is still not fine grained enough.

We need to focus on the most often discussed legal entities for these purposes: C Corporations (C Corps), S Corporations (S Corps), Limited Liability Companies (LLCs), and Partnerships (ex-LLCs).

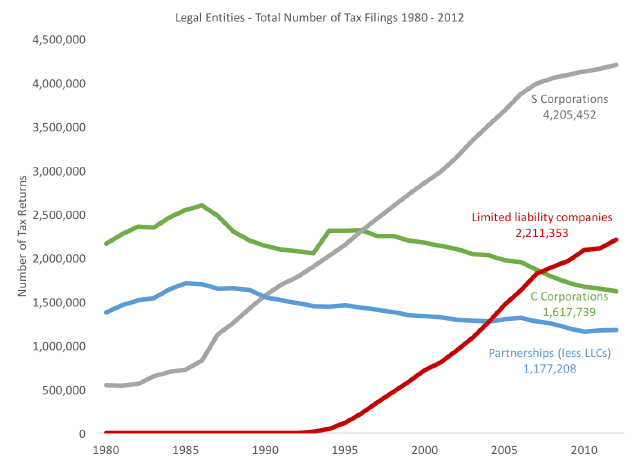

C Corps v. S Corps. v. LLCs v. Partnerships

Showing S Corporations, Limited Liability Companies, C Corporations, and Partnerships (ex-LLCs). It is also clear that number of corporations and partnerships (all types, excluding LLCs) have steadily declined since the mid 1980’s. Corporations seem to have enjoyed a brief renaissance in the mid-1990’s before resuming their gradual decline.

It is important that we make another adjustment to the IRS data. The IRS data classifies LLCs as a type of partnership, along with general and limited partnerships. The historical reason is understandable.

S Corporations rule the roost in large part because the combination of tax status and corporate form from the 1950’s. Wyoming first adopted a limited liability company statute in 1977. The IRS first began reporting LLCs as a separate line item in the tax return data in 1993.

LLCs did not take off until 1997 when the IRS’s adoption of the check-the-box rule - that businesses organized as LLCs could decide whether they wanted to be taxed as partnerships or corporations - became effective. For a useful history of limited liabilities companies, see this article published by the American Bar Association.

So LLCs are usually pass-through entities like partnerships. LLCs are, however, distinct legal entities under state law with unique characteristics. Therefore, it is important to peel them out of the bundle of partnerships and look at them on their own.

The decline in corporations and partnerships from 1985-1995 is correlated to a period of rapid growth in S Corporation returns. In 1987, for example, there were 36.5% more S Corporation returns filed than in 1986. Rapid growth in LLCs from the mid-1990’s through 2000 contributed to the decline in corporations and partnerships.

The number of corporate tax returns has declined on average over 30 years by one percent (-0.84%). Partnerships, including all types except LLCs, have also declined on average by a little less than half a percent (-0.46%).

The average annual growth in S Corporations is 6.8% over 30 years. The average annual growth in LLCs is even more dramatic and compelling: 21% (20.93%). Consider that this average growth includes the years 1980 - 1992 before the IRS tracked LLC filings separately and the value was zero.

What are the implications of these long term trends?

Long term trends

S Corporations outnumber all other entities 2:1

S Corporations clearly lead the pack (except for sole proprietorships) with reasonably steady growth for over 30 years. With 4.2 million S Corporations filing tax returns in 2012, there are almost two S Corporations for every LLC, the next closest rival.

The S Corporation was the primary alternative for businesses wanting tax benefits over the double taxation regime for C corporations’ income and dividends until limited liability companies came onto the scene.

LLCs are now the most popular legal entity

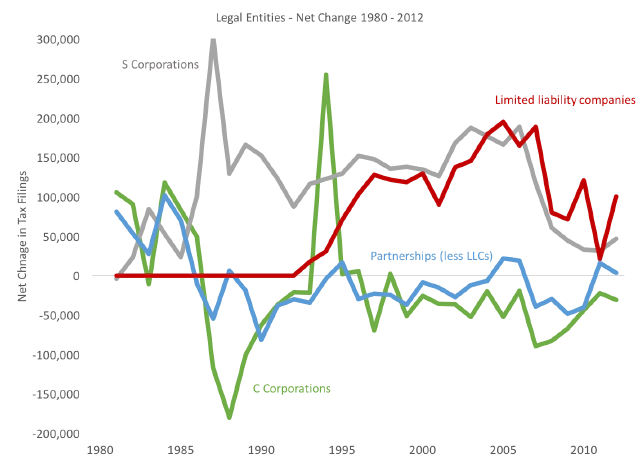

While it is tempting to conclude that S Corporations are substantially more popular than LLCs, this conclusion is based on the total number of legal entities. S Corporations have a more than 15 year head start on LLCs. Adjusting for that head start, the data reveals that LLCs are eclipsing S Corps.

There are two indicators of the parity between S Corporations and limited liability corporations. One simplistic approach is to back out the 1,785,371 S Corporation returns filed in 1992, the year before the IRS began reporting LLC returns as a separate line item. With that adjustment, LLCs almost catch up entirely to S Corporations by 2012: 2.4 million S Corporations; 2.2 million LLCs.

Looking at the year-over-year net change in tax filings demonstrates that LLCs have a slight edge over S Corporations since 2004, except for 2006. The year-over-year net change captures the addition (or reduction) in tax returns from the prior year by legal entity type.

The 30 year chart of this data is revealing, especially after the check-the-box ruling on LLCs:

Conclusions

These trends and the IRS data are certainly no substitute for legal advice about which entity is suitable for any given startup, joint venture, or corporate entity.

For lawyers and corporate secretaries responsible for a significant corporate registry, this data serves as a useful benchmark of existing and new entities in the corporate family.

https://www.irs.gov/uac/soi-tax-stats-integrated-business-data ↩︎

The IRS data changed its data classification of partnerships, particularly limited partnerships, more than once from 1980-1993. Partnerships also include limited liability companies (LLCs). To address both issues, Partnerships in this article include general partnerships, limited partnerships, and other partnership forms, but exclude limited liability companies. LLCs appear as their own line. ↩︎